News and Insights

Robert F. Mancuso kicks off 2026 with a new piece featured in Bloomberg Tax, offering an updated outlook on the wealth tax movement in the U.S.

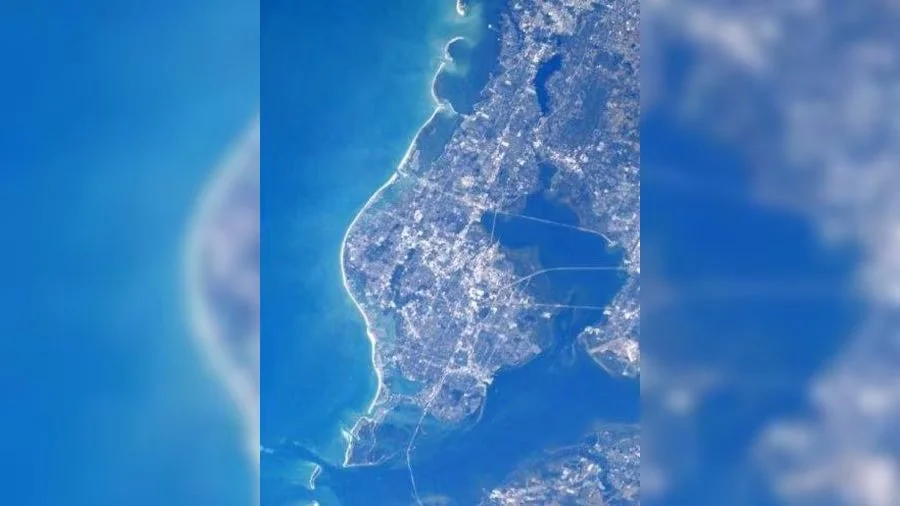

In the Tampa Bay area, nearly one in three business owners is an immigrant.

Robert F. Mancuso writes in Bloomberg Tax on the news of Taylor Swift and Travis Kelce's engagement — "Make no mistake—this isn’t just a marriage. It’s a merger."

Featured in Bloomberg Law, Robert F. Mancuso speaks on how family businesses can now navigate the Great Wealth Transfer with confidence and clarity.

In his latest column, featured in the Chicago Tribune, Capri Capital Partners CEO Robert F. Mancuso writes a warning to family-held businesses: debt driven private equity buyouts can dismantle generations of legacy.

Capri Capital’s Robert F. Mancuso has been appointed to the Policy and Taxation Group's newly created Advisory Board.

In his latest op-ed featured in The Palm Beach Post, Robert F. Mancuso once again spotlights Florida’s anticipated $885 billion Great Wealth Transfer due to unfold over the next decade.

Over the next decade, nearly $885 billion will change hands in Florida as wealth moves from one generation to the next.

On March 11 2025, Family Enterprise USA (FEUSA), in coordination with the Congressional Family Business Caucus, held its first Washington D.C. event of 2025.

Robert F. Mancuso’s newest article, “Death and Taxes: A New Take on an Old Problem”, is now featured on RealClearMarkets.

Robert F. Mancuso’s most recent article, “An Under Appreciated Risk to Family Legacies”, has been published by Family Enterprise USA and the Policy and Taxation Group.

On September 18th 2024, Members of Congress, congressional staff, family-owned businesses and the Family Enterprise USA organization gathered in Washington D.C. to participate in the 3rd Congressional Family Business Caucus event of 2024.

A growing segment of our population doesn’t seem to believe that entrepreneurial success is beneficial to society.

That seems like an odd statement. Many politicians and elected officials espouse an affinity for success. Again and again, in speech after speech, we hear their promises to do all in their power to support and strengthen the concept of innovation and personal success. But do they?

If the frequency with which a word is used is an accurate measure of its place in society, then every reader of the Wall Street Journal and the Financial Times could likely conclude that the financial media and society at large are obsessed with recessions.

Recent events in both the United States and Europe have shocked the investment world.

The rapid collapse of Silicon Valley Bank, Silvergate Bank, and Signature Bank all in the United States and all within a matter of days, produced a fear that a full-scale U.S. banking crisis was about to unfold. And before investors could absorb the significance of those domestic bank failures, a 167-year-old institution and one of the leaders throughout the World – Credit Suisse – was acquired by its arch competitor, UBS, in a hastily-arranged merger negotiated at the urging of the Swiss government.